The Rome Syndrome: Why Vendor Empires and Their Customers Are Crumbling Together

How companies can start owning their data and intelligence in a composable way breaking out of the one-big-platform trap

Lessons From Old Columns

Apologies for going quiet last week—I took a quick spring break and finally got to spend some time in Rome. The trip left me with this strange new fixation: everywhere I looked, those ancient columns, still standing after centuries, but only because layers of scaffolding and endless patchwork are holding them up. Funny how we talk about engineering marvels, data engines and lasting legacies, but often it’s just our determination to keep propping things up, layer by layer, that keeps them from crumbling. There’s a real warning in that for tech leaders. Even the most awe-inspiring platforms begin to show their cracks if you look closely enough.

Rome wasn’t built in a day, and it didn’t collapse overnight either. Same goes for enterprise tech platforms. CDPs and data platforms once seemed every bit as solid and eternal as those ruins—until new realities swept in.

The Real Collapse: When Scale Stops Being an Advantage

It used to be that the biggest vendors ran the show by making data integration so complex (and so expensive) that you really had no choice but to buy into the all-in-one dream. For a while, that felt safe. But the world got messy—data is everywhere, spinning up a new pipeline is basically table stakes, and whatever “moat” those platforms once claimed has long since evaporated.

These days, just holding a ton of data doesn’t get you anywhere. The real challenge? Making data actually matter, for one customer, in a single micro- moment, in a world that never slows down.

Or if everyone just relies on one third-party data vendor, instead of drawing from multiple sources—Experian, ZoomInfo, D&B, 6Sense—you end up losing your strategic edge without even realizing it.

Here’s what this looks like up close: A CDO at a luxury retailer walked me through her “vendor cemetery” last month. Fourteen platforms. Thirty-eight million dollars. And still, their best customers get emails for products they already bought ages ago. “We’ve been in perpetual migration mode,” she sighed. “Every new tool was supposed to be the one.” And yet, they’re all just scaffolding, holding up something that clearly wants to fall.

Old Gladiators, New Agents

Cast your mind back—digital transformation used to mean armies of people wrestling with spreadsheets, CoE (center of excellence), hand-coding integrations, and fighting a never-ending uphill battle with their own data. We all became tech gladiators, more or less, hacking our way through it.

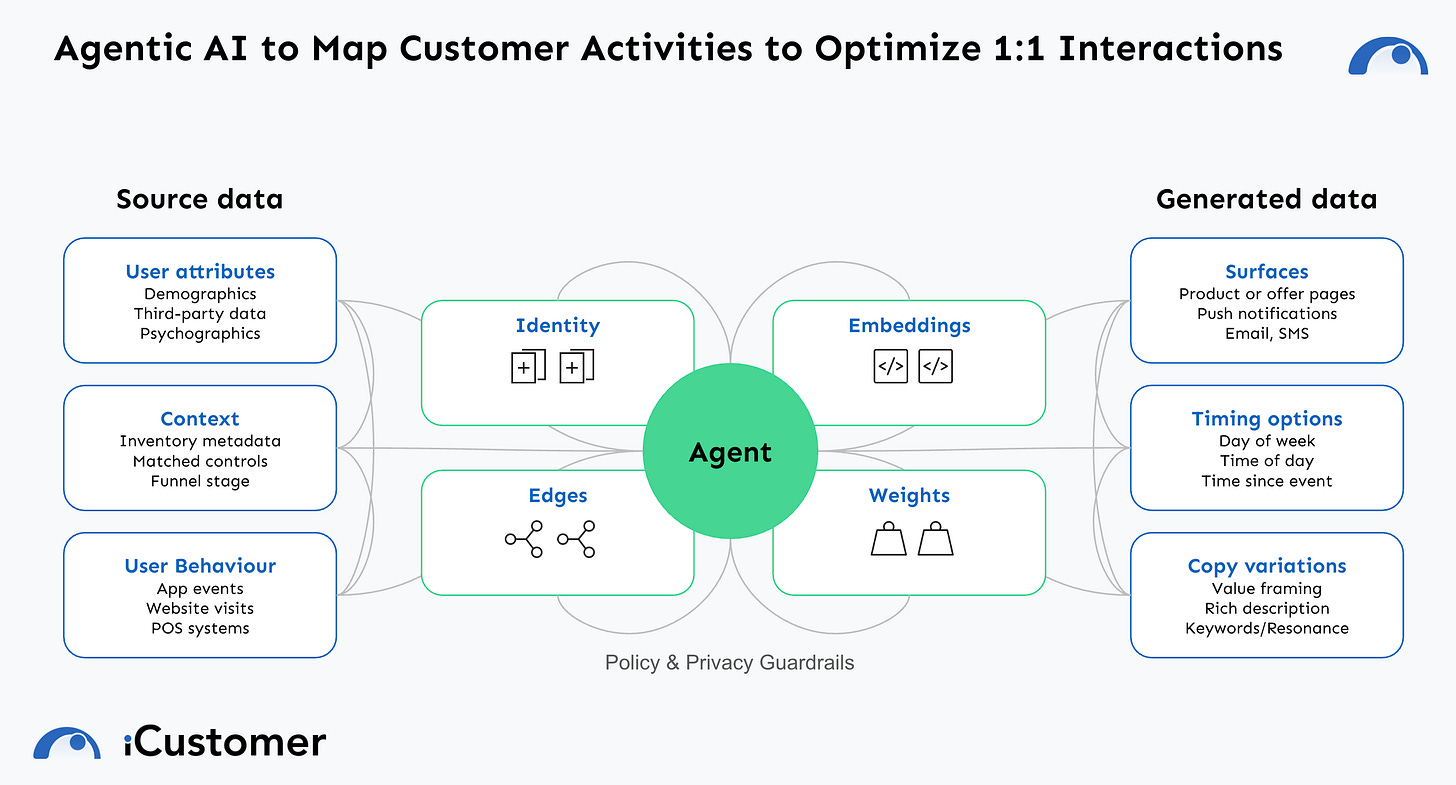

But that era’s over. Now, intelligent agents—digital “specialists” in their own right—are doing the heavy lifting. They interpret, connect, act, and adapt at a speed and scale no human team could keep up with. But here’s the point: these agents aren’t about cutting people out of the picture. They’re there to handle the repetitive and contextual work, so the real human teams can move up the value chain, focusing on bigger, better decisions. The future’s already being claimed by those who can make these agents sing together.

Take ServiceNow: in their last earnings call, they talked about a 16x leap in lead-to-sale conversions with an agentic approach. Their CEO said it slashed 86% of what he called “soul-crushing work” that used to land on people’s desks. That’s not tweaking at the margins. That’s a wholesale change.

Can ServiceNow continue using 6Sense or Salesforce for years would have got this?

What Separates Winners From the Rest

Once collecting data becomes easy (and it has), the edge shifts to what you do with it—to discernment, to living intelligence:

Owning your memory: Letting persistent intelligence flow across channels, not get walled off in tool after tool.

Continuous learning: Feedback loops that genuinely get smarter, every single time someone interacts.

Composable architecture: The ability to drop in new tools and agents, without tearing the whole house down.

The empires that ruled yesterday did it with big, monolithic, locked-up systems. But now? The advantage is all about the intelligence layer—being the one to decide what your data means and how it drives real-time action. And according to McKinsey, just 24% of companies actually think their stack is ready to support real AI. Everyone else is basically building castles on sand and hoping the tide holds.

Five Pillars of the New Knowledge Stack to enable Decision Intelligence

Ontologies: Human-level concepts and relationships, finally made machine-readable, so your stack can understand context (not just keywords).

Knowledge Graphs: A living network, always connecting customers, products, moments—no more static profiles gathering dust.

Model-Context Protocols (MCP): Real-time interpreters that deliver only what each agent or application really needs, when they need it.

Agent-to-Agent Protocols: A universal language that lets your recommendation engine, inventory system, and customer AI actually collaborate beyond frameworks & platforms.

Composability: True plug-and-play architecture. It means you can integrate, adapt, and evolve without sweating the legacy stuff. Gartner sees it: companies going composable will outpace others by 80% in shipping new features.

Real Results, Not Promises

This isn’t just theory. ServiceNow is the latest public company examples. But the companies taking this leap are seeing it on the bottom line:

18% boost in search-to-cart conversions after rolling out semantic search

22% drop in return rates, just by matching product attributes to actual customer profiles

3.4x better personalization, using intelligence they actually own, not some vendor’s black box

47% better customer lifetime value, thanks to true continuous learning

Bain summed it up in their latest research: data strategy is now the single greatest differentiator for consumer business in the AI era.

Monday Morning Moves

So what next? Start with the basics:

List out every business decision still getting jammed up by manual data refreshes.

Pilot a micro-agent—maybe a cart abandonment follow-up that writes outcomes right back to your knowledge graph.

Measure how tight you can make your decision loop: signal → decision → action → feedback. At iCustomer, we call this “decision intelligence”—and the tighter your loop, the more your stack compounds its value.

The Takeaway

The lesson from Rome isn’t just decline—it’s survival, and adaptation. Vendor empires start falling apart the moment they confuse size for agility. Today’s advantage? Owning the intelligence you build, powered by agents you steer in a composable stack—not by clinging to yesterday’s platforms and hoping the scaffolding holds.

If your roadmap still reads 90% plumbing, it’s time to get serious about the intelligence layer—the only part that really turns data into business results.

Have you seen the same cracks in your own vendor stack, or found new approaches that actually work in this AI-first world? I’d love to hear your stories in the comments.

Join the Conversation

Is your team still fighting disconnected systems & events? or confused about Agents or GPT powered claims Or have you started the knowledge engineering journey? Would love to hear how you’re tackling this shift—drop your experiences in the comments.

The challenge is that organizations have so much invested in that brittle and difficult to evolve legacy plumbing that it is rare for them to set aside those outdated investments. A great deal of resources are put into data and application fiefdoms and those who lead those fiefdoms do not want to give up their kingdoms and associated resources. As you point out, the critical element is owning your data and leveraging it rather than seeming advantage from a public model.

As you have observed before the knowledge engineering part of this leverages an organization’s unique understanding of customers, markets, solutions and the competition.

It’s activating those knowledge insights to power customer and employee experience that provides a true competitive advantage.

There’s something to be said about an integrated platform, but rarely are those platforms as well integrated as the marketing suggests. They are usually a conglomeration of acquisitions with disparate architectures that don’t necessarily talk well to one another.

Even when they are well integrated, getting locked into a vendor platform significantly limits the ability to use best of breed components as they emerge in the market.